A ________-sharing Plan Is Another Name for a Profit-sharing Plan.

It allows the employer to choose how much to contribute to the plan out of profits or otherwise each year including making no contribution for a year. The 401k profit-sharing plan is often confused with regular profit-sharing plans where the employer gives the employee a portion of the company profit.

What Is Planning Planning Involves Defining The Organization S Goal Establishing Strategies For Achieving Those Goals And Developing Plans To Integrate Ppt Video Online Download

Its a great way to give your team extra money without creating entitlement because its directly tied to their hustle.

. A profit-sharing plan is a type of incentive plan where businesses give indirect or direct payments to employees. Choosing a Retirement Plan. As a corporate executive Susan earns 350000 per year.

Distributions to participants from profit sharing plans are typically. Also referred to as a Defined Contribution DC plan profit sharing relies on employer contributions made to employee accounts. Exclude employees that work less than 1000 hours while a SEP excludes employees who work less than 3 of 5 years or have less than 650 in pay.

A profit-sharing plan can also allow participants to borrow from their plan account. A 401 k plan with a profit-sharing feature allows an employer to make contributions to their employees 401 k accounts based on the companys profits. A profit-sharing plan is a retirement plan that gives employees a share in the profits of a company.

When a business chooses to participate in a profit-sharing program the business owner agrees to make generous contributions that offer tax-deferred growth and are tax-deductible. Employers can decide how much to contribute based on the companys profits or other cash flows after the plan year ends. These plans allow companies to pass along some of their profits to employees in a tax-advantaged way.

A profit sharing plan is a type of plan that gives employers flexibility in designing key features. A profit-sharing plan is a kind of retirement benefit plan in which employees get a specific percentage share in the companys quarterly or annual profit after their retirement. A profit-sharing plan accepts discretionary employer contributions.

Profit Sharing Plans provide the most flexibility among qualified plans available. Under this type of plan also known as a deferred profit-sharing plan DPSP an employee. Employees do not have to make their own contributions to profit-sharing plans.

Businesses with these plans are sharing any profits theyve earned with their workers. A profit-sharing plan gives employees a portion of the profits a company earns. It is up to the company to decide how much of its profits it wishes to share.

If you can afford to make some amount of contributions to the plan for a particular year you can do so. A profit-sharing plan takes a percentage of the companys profits and shares it with the team on top of their compensation plan. A profit-sharing plan is similar to a 401k plan but more flexible for the employer.

A _____-sharing plan is another name for a profit-sharing plan. In general profit-sharing gives employees an explicit stake in a companys profits. It allows you to choose how much to contribute to the plan out of profits or otherwise each year including making no contribution for a year.

However this is dependent on various factors. N Can help attract and keep talented employees. Allow for loans to participants while a SEP may not make loans.

Some plans may allow for periodic distributions annuities or other lifetime income distribution options. Taken in a lump sum or rolled over to an IRA or another employers retirement plan. This is more flexible than an employer match which is a fixed contribution.

Contributions to a profit-sharing plan are made by the company only. A profit sharing plan is a type of plan that gives employers flexibility in designing key features. A profit-sharing plan is a defined contribution pension plan in which the workers and employees are given an opportunity to obtain their share in the overall profit of the organization in such a way that they are encouraged to contribute more and more to the profit of the organization and motivates to give their best efforts thus it is an incentive plan that gives a variable benefit to.

As of 2014 her employer can only contribute 52000 maximum to her profit-sharing plan as per the IRS contribution cap. Profit sharing plans have additional advantages. A profit sharing plan is a defined contribution plan that allows employers to make a contribution as a percentage of plan compensation or a flat dollar amount depending on the terms of the plan document.

A profit-sharing plan gives employees a share in their companys profits based on its quarterly or annual earnings. An employer may allocate up to 100 of the participants compensation or 56000 indexed to the cost-of-living whichever is less. A business does not have to make contributions to the plan in years that its not profitable.

Require vesting that rewards longer-term employees while a SEP is always 100 vested. A profit-sharing plan is a type of retirement plan that companies of all sizes can offer to their employees. The SECURE Act made it easier for businesses to adopt a new Defined Benefit Pension Cash Balance Profit Sharing 401k Plan by extending deadlines.

A _____-sharing plan is another name for a profit-sharing plan. With a Profit Sharing Plan an employer can add up to 25 of total compensation to all eligible employees. With a 401k profit-sharing plan employers can contribute to their employees retirement account at the end of the year.

Group of choices gain substitution compensation value rewards. There is no set amount that the law requires you to contribute. Employers pool profits into a contribution fund which they distribute to all employees based on a pre-determined formula.

Other years you do not need to make contributions. Employers start a profit sharing plan for additional reasons. This type of retirement plan which is also known as.

A profit-sharing plan may. They offer flexibility to employers and are easy for participants to understand. Processing a rollover from a profit-sharing plan or qualified plan such as a 401k is fairly straightforward as long as you follow the IRS guidelines for rollovers4 However its important to verify that the plan administrator will allow an IRA transfer from the profit-sharing plan into a SEP IRA.

Group of answer choices gain substitution compensation value. The contributions are not actually based on the profitability of the company but rather the compensation of the eligible employees. Employees cannot make them too.

They come with plenty of benefits for both employers and employees including helping companies to attract skilled workers and helping employees to. Unlike Defined Benefit Plans employers are not required to. This is a way to make employees feel that they belong to the company they are working in which further helps in creating a sense of ownership.

What Does a Profit-Sharing Plan Mean. Profit Sharing Plans are another popular retirement plan option available to small and mid-sized businesses.

Planning Process 8 Important Steps Of Planning Videos And Examples

What Is Planning Planning Involves Defining The Organization S Goal Establishing Strategies For Achieving Those Goals And Developing Plans To Integrate Ppt Video Online Download

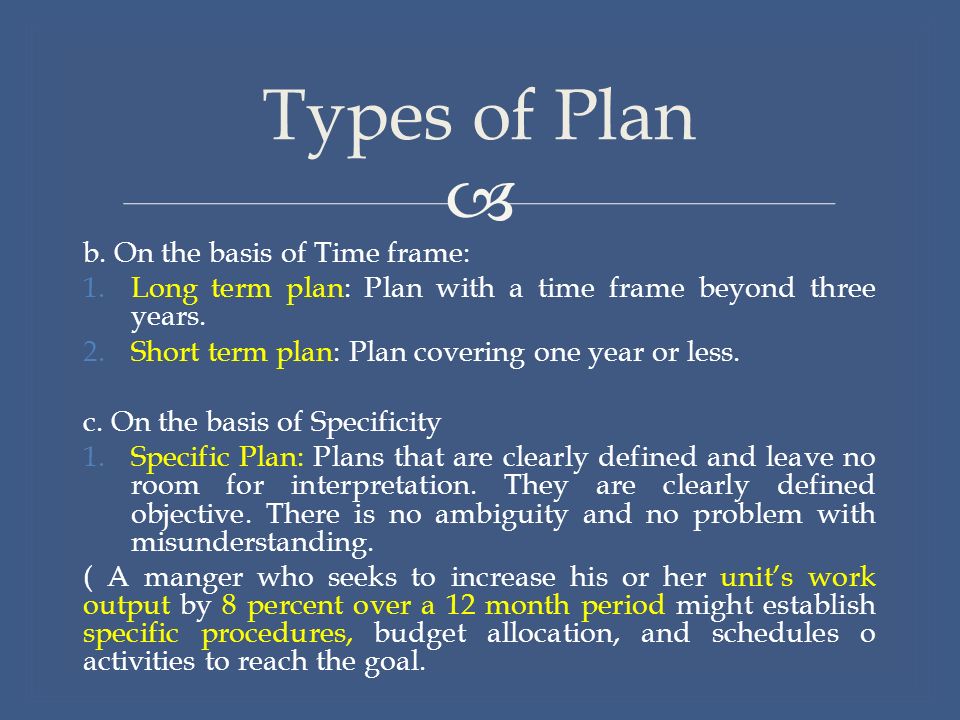

Types Of Plan Strategy Policy Rules Budgets Methods With Examples

Comments

Post a Comment